Starting a laundry business involves several legal requirements to ensure compliance and smooth operation.

This guide is tailored for you, offering detailed insights into the specific legal requirements needed to establish and run a laundry business effectively.

This guide outlines the essential legal steps:

- Business Model: The most crucial decisions you’ll make as an entrepreneur is selecting the right business.

- Business Registration: Register your business with the appropriate local authorities to obtain a legal identity.

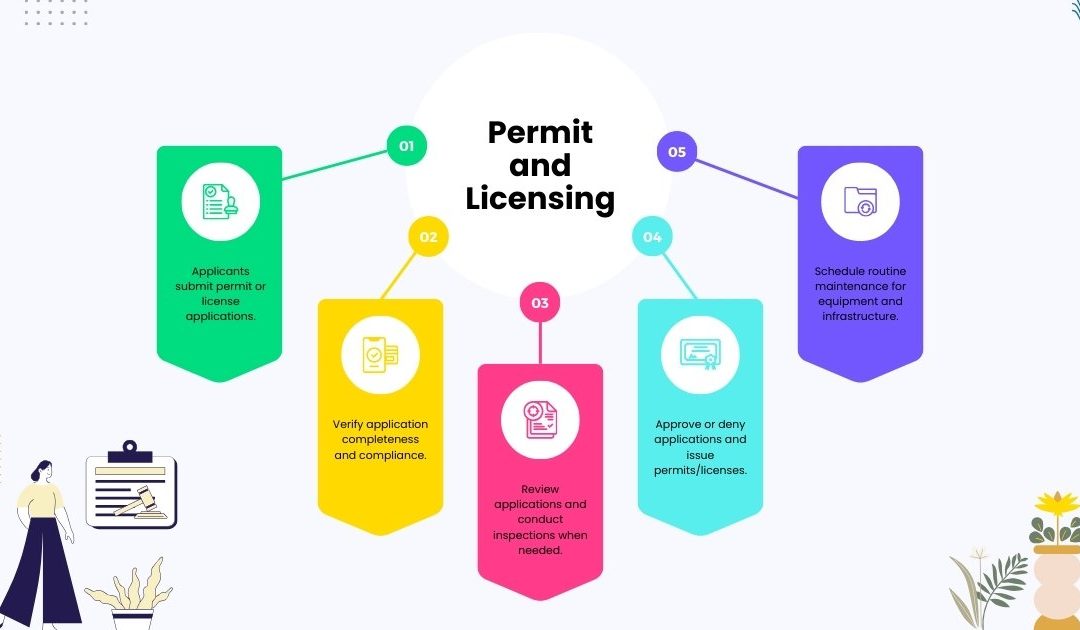

- Licenses and Permits: Acquire necessary licenses and permits, which may vary based on location and services offered.

- Environmental Compliance: Ensure compliance with environmental regulations, particularly concerning water and chemical usage.

- Insurance: Obtain relevant insurance policies to safeguard against potential liabilities.

- Employment Laws: Familiarize yourself with employment laws to manage staff legally and ethically.

- Tax Obligations: Understand and fulfill your tax obligations for smooth financial operations.

Dive into this essential resource to empower your laundry business with the right legal foundation.

Table of Contents

- Introduction

- Choosing Your Business Structure

- The Registration Process

- Essential Licenses and Documents

- Hiring the Right Professionals

Introduction

Starting a laundry business in India is more than just washers and dryers. It’s about understanding the legal landscape, ensuring compliance, and setting a strong foundation for your entrepreneurial journey. This guide aims to simplify the process for you.

Choosing Your Business Structure

One of the first and most crucial decisions you’ll make as an entrepreneur is selecting the right business structure.

This choice will influence your personal liability, registration process, taxation, and even your ability to raise funds. Here’s a comprehensive breakdown of the various structures available in India:

1. Sole Proprietorship

A sole proprietorship is the simplest form of business structure, ideal for individual business owners.

Here’s what you need to know:

- Ownership: Owned by a single individual.

- Liability: The owner has unlimited personal liability. This means if the business incurs debts, the owner’s personal assets can be used to settle them.

- Registration: Minimal registration requirements. Often, a trade license and GST registration (if applicable) are sufficient.

- Taxation: Profits are taxed as the personal income of the owner.

2. Partnership

When two or more individuals come together to start a business, a partnership can be a suitable option. Here are its features:

- Ownership: Owned by two or more individuals.

- Liability: Partners have unlimited personal liability, similar to a sole proprietorship.

- Registration: Requires a partnership deed, which outlines the terms and conditions between partners. Registration with the Registrar of Firms is recommended but not mandatory.

- Taxation: Profits are taxed as the personal income of the partners based on their share.

3. Limited Liability Partnership (LLP)

LLP is a modern business structure that combines the benefits of partnerships and companies. Here’s a closer look:

- Ownership: Owned by two or more partners.

- Liability: Partners have limited liability, which means their personal assets are protected against the debts of the LLP.

- Registration: Requires registration with the Ministry of Corporate Affairs (MCA). An LLP agreement is also essential.

- Taxation: LLPs are taxed at a flat rate on their profits.

4. Private Limited Company

For those looking for a more structured setup with the ability to raise funds, a private limited company is the way to go:

- Ownership: Owned by shareholders and managed by directors.

- Liability: Shareholders have limited liability up to the value of their shares.

- Registration: Requires registration with the MCA. The process involves obtaining a Director Identification Number (DIN), reserving a unique company name, and filing incorporation documents.

- Taxation: Companies are taxed at a flat corporate tax rate on their profits.

In your choice of business structure should align with your business goals, financial capabilities, and risk appetite. It’s always advisable to consult with a legal or business expert to make an informed decision.

The Registration Process

Registering your laundry business is a pivotal step in legitimizing your venture and ensuring compliance with Indian laws. The process varies depending on the business structure you choose.

Here’s a comprehensive breakdown:

Here’s a comprehensive breakdown:

1. Sole Proprietorship

Given its simplicity, the registration process for a sole proprietorship is relatively straightforward:

- Trade License: Apply for a trade license from the local municipality or city corporation. The requirements might vary based on your location.

- GST Registration: If your annual turnover exceeds the threshold limit set by the government (which may vary from year to year), you’ll need to register for the Goods and Services Tax (GST).

- Bank Account: Open a separate bank account in the name of the business. While not mandatory, it’s advisable for clearer financial records.

2. Partnership

For businesses with multiple owners, here’s how to register a partnership:

- Partnership Deed: Draft a partnership deed detailing the terms, conditions, and roles of each partner. This document should be signed by all partners and notarized.

- Registrar of Firms: While not mandatory, it’s advisable to register the partnership with the Registrar of Firms in your state. This provides legal recognition and protection.

- GST Registration: If applicable, register for GST.

3. Limited Liability Partnership (LLP)

LLP offers a blend of partnership and corporate benefits. Here’s the registration process:

- Obtain DSC: Before initiating the LLP registration, all partners must obtain a Digital Signature Certificate (DSC).

- Reserve Name: File an application to reserve your desired LLP name with the Ministry of Corporate Affairs (MCA).

- Incorporation: Once the name is approved, file the incorporation documents with the MCA.

- LLP Agreement: Draft and file an LLP agreement, which outlines the structure and operational guidelines of the LLP.

- GST Registration: If applicable, register for GST.

4. Private Limited Company

For a more structured setup, here’s how to register a private limited company:

- Obtain DSC: All directors must obtain a Digital Signature Certificate (DSC).

- Director Identification Number (DIN): Every director should have a DIN, which can be obtained by filing an application with the MCA.

- Name Reservation: Reserve your desired company name with the MCA.

- Incorporation: Once the name is approved, file the incorporation documents, including the Memorandum of Association (MoA) and Articles of Association (AoA), with the MCA.

- PAN & TAN: After incorporation, obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for your company.

- GST Registration: If applicable, register for GST.

while the registration process might seem intricate, following these steps methodically will ensure a smooth setup for your laundry business.

It’s always beneficial to consult with professionals during this phase to ensure accuracy and compliance.

Download Free

Google Ads PPC Strategies Tailored for Laundry Industry

Whether you are starting to research Google Ads (Pay-per-Click) or are ready to set up your first campaign, use these workable and proven strategies to get started. Scale up your lead generation efforts and achieve unparalleled results. Reach Idea Customers, Convert Clicks into Customers – Let's Optimize Google Ads Campaign Today!

Essential Licenses and Documents

Starting a laundry business in India requires more than just a passion for entrepreneurship. It’s crucial to ensure that your business operates within the legal framework, which means obtaining the necessary licenses and documents.

Here’s a beginner-friendly guide to help you navigate this process:

1. Trade License

This is the primary license you’ll need to operate a business in India.

- What is it?: A permit issued by the local municipal corporation that grants permission to run a particular trade or business.

- How to Obtain: Visit your local municipal corporation office or their official website. Submit the required application form along with necessary documents like address proof, identity proof, and premises details. Once approved, you’ll receive the license.

- Validity: Typically valid for one year and needs annual renewal.

2. GST Registration

With the implementation of the Goods and Services Tax (GST) in India, it’s essential for businesses to register if they meet certain criteria.

- What is it?: A tax registration required for businesses involved in the selling of goods or providing services.

- How to Obtain: Register online through the official GST portal. You’ll need to provide details about your business, bank account, and the goods or services you offer. Once verified, you’ll receive a unique GSTIN (GST Identification Number).

- When is it Required?: If your annual turnover exceeds the threshold limit set by the government, which may vary based on the type of business and location.

3. Shop and Establishment Act License

Every commercial establishment in India, including laundry businesses, needs to register under this act.

- What is it?: A license that governs the working conditions, rights of employees, and other conditions of work.

- How to Obtain: Apply through the labor department of your state. The process might vary slightly from one state to another, but generally, you’ll need to submit an application with details of your business and its employees.

- Validity: Needs periodic renewal, typically every year.

4. Trademark Registration

If you want to protect your brand name, logo, or slogan, consider trademark registration.

- What is it?: A sign capable of distinguishing the goods or services of one enterprise from those of other enterprises.

- How to Obtain: Apply online through the official website of the Controller General of Patents Designs and Trademarks. Once your application is filed, it will undergo examination, and if approved, your trademark will be registered.

- Benefits: Provides legal protection against unauthorized use of your brand name or logo.

while the process of obtaining licenses and documents might seem overwhelming at first, it’s a crucial step in establishing a legitimate and successful laundry business.

Always keep these documents updated and renew them as required. For a smoother experience, consider seeking assistance from professionals or agencies that specialize in business registrations and licenses.

Hiring the Right Professionals

Embarking on your entrepreneurial journey can be both exciting and overwhelming. While you bring passion and vision to your laundry business, there are intricate legal, financial, and operational aspects that might be unfamiliar to you.

That’s where professionals come in. They not only bring expertise but also ensure that your business sails smoothly through the complexities of the startup world.

1. Chartered Accountant (CA)

Think of a CA as your financial compass.

- Role: CAs handle financial planning, tax management, auditing, and financial reporting. They ensure your business remains financially healthy and compliant with tax regulations.

- Why Hire?: A CA can guide you on tax benefits, manage your accounts, and provide insights into financial decisions. Their expertise can save you money and potential legal hassles in the long run.

2. Company Secretary (CS)

A CS is like the legal guardian of your business.

- Role: They handle all formalities related to the Ministry of Corporate Affairs (MCA), ensure compliance with various regulations, and assist in drafting legal documents.

- Why Hire?: Especially if you’re registering as a Private Limited Company or LLP, a CS ensures that all legal protocols are followed, safeguarding you from potential legal pitfalls.

3. Lawyer

Your business’s legal shield.

- Role: Lawyers assist with drafting contracts, protecting intellectual property, and offering legal advice on various business matters.

- Why Hire?: From employee contracts to potential disputes, having a lawyer by your side ensures that your business interests are always protected.

while you might be tempted to handle everything on your own to save costs, remember that mistakes, especially legal or financial, can be costly in the long run.

Investing in the right professionals is like setting a strong foundation for your laundry business. They not only guide you but also empower your business to grow and thrive in a competitive landscape.

Ready to Launch Your Laundry Business? Take the Next Steps Now!

You’ve armed yourself with essential knowledge about starting a laundry business in India. From choosing the right business structure to understanding the nuances of registration, licenses, and the importance of hiring professionals, you’re now well-equipped to embark on this exciting journey.

But remember, knowledge is just the beginning. Action is the key to turning your entrepreneurial dreams into reality.

Here’s a quick action plan to get you started:

-

Research and Decision: Revisit the business structures and decide which one aligns best with your vision and resources. Whether it’s a Sole Proprietorship or a Private Limited Company, make an informed choice.

-

Documentation: Gather all necessary documents. Whether it’s proof of address, identity, or any other relevant paperwork, having everything in order will expedite the registration process.

-

Consultation: While you’re equipped with knowledge, seeking advice from professionals can offer tailored insights. Consider scheduling consultations with a Chartered Accountant, Company Secretary, or Lawyer to discuss your specific needs.

-

Budgeting: Factor in all costs, from registration fees to hiring professionals. Setting a clear budget will ensure you’re financially prepared for every step.

-

Finalize Location: If you haven’t already, finalize the location for your laundry business. Ensure it’s accessible to your target audience and complies with local regulations.

-

Take Action: With everything in place, initiate the registration process. Whether you’re doing it yourself or with the help of professionals, ensure every step is meticulously followed.

Starting a business is a blend of passion, knowledge, and action. You’ve got the passion and knowledge; now it’s time for action. Dive in, and soon, the hum of washing machines and the sight of satisfied customers will be a testament to your entrepreneurial spirit.

Remember: Every successful business started with a single step. Your laundry journey awaits. Embrace it with confidence and enthusiasm!

FAQs:

What’s the first step in starting a laundry business?

Begin by choosing a suitable business structure like Sole Proprietorship, Partnership, LLP, or Private Limited Company. This decision impacts liability, taxation, and fundraising.

How do I legally register my laundry business?

Registration varies by business type. For instance, Sole Proprietorships need minimal registration, while Private Limited Companies register with the Ministry of Corporate Affairs.

Are there specific licenses I need?

Yes, you’ll require a Trade License from the local municipality, GST Registration if your turnover exceeds a set limit, and a Shop and Establishment Act License.

Should I protect my brand name?

Absolutely! Consider Trademark Registration to legally safeguard your brand name, logo, or slogan from unauthorized use.

Why hire professionals like CAs or lawyers?

Professionals guide you through financial, legal, and operational complexities, ensuring your business remains compliant and financially sound.

Is GST registration mandatory for all?

Not always. You need GST registration if your annual turnover crosses the threshold set by the government, which can vary yearly.

What role does a Company Secretary play?

A Company Secretary ensures compliance with various regulations, assists in drafting legal documents, and handles formalities related to the Ministry of Corporate Affairs.

Download Your Free

Complete Local SEO Strategy

Download our comprehensive Local SEO Strategy designed exclusively for Laundry Solutions and Business! Discover the proven tactics to boost your online visibility, Grow Revenue and Get more local customers from search engines for FREE

Promote Your Laundry Business Online with Proven Online Marketing Strategies!

Unlock the Secrets of Google Ranking Optimization Strategies , Fast-Track Your Laundry Business Success with Mastermind Mr. Ram

Related Articles

Which AI Tools Are Used by Top SEO Agencies in the AI Transformation Era?

AI isn’t just disrupting SEO — it’s rebuilding it from the ground up. The world’s top SEO agencies are no longer relying on manual spreadsheets or...

Hire LLM Optimized SEO Service & Rank Faster | Get Yours

Every single day you postpone, your competitors are capturing market share in a new arena: AI Answer Engines. The digital landscape has fundamentally...

LLM Retrievable Content Creation Services: Future-Proof Your SEO with AI Agent-Ready Content

As search evolves beyond simple keyword matching, traditional SEO strategies are becoming obsolete. LLM retrievable content creation services are...

AI Powered SEO Services: Transform Your Digital Visibility and Rank Smarter

In today's fast-paced digital landscape, businesses struggle with traditional SEO methods that often fall short in efficiency and...

AI Powered Marketing for Laundry, Dry cleaners Services Business with Smart AI Automation

Why Read This? AI Marketing Is Changing Laundry Businesses Are you a laundry or dry cleaning business owner looking to grow faster in today’s AI era?...

AI-Driven SEO Services: A Game Changer for Laundry & Dry Cleaning Businesses

AI-Driven SEO Services: How Laundry & Dry Cleaning Businesses Win Online Imagine a customer urgently needing their clothes cleaned. They pull out...

Disclaimer: The brands / costs / Information mentioned in this blog are the recommendations provided by the author. FlexWasher-Laundry Website does not claim to work with these brands / represent them / or are associated with them in any manner. Investors and prospective franchisees are to do their own due diligence and in-depth research before investing or Purchase in/on a business/Product/Services at their own risk and discretion. FlexWasher-Laundry Website or its Directors disclaim any liability or risks arising out of any transactions that may take place due to the information provided in this blog.